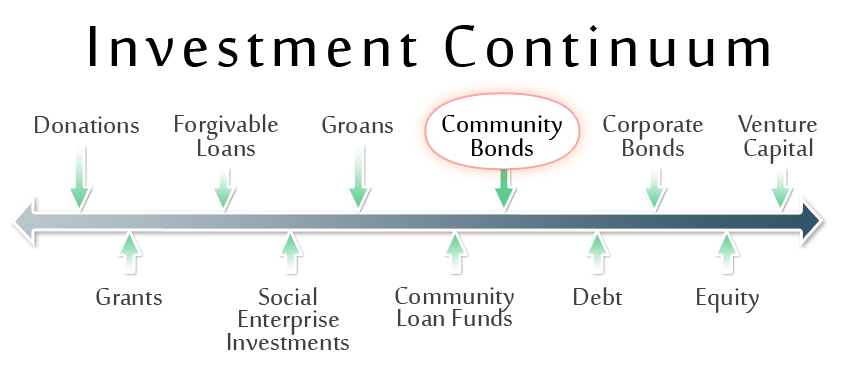

Community Bonds are an existing financial tool which is emerging within the non-profit sector as an innovative way for non-profit organizations to attract capital. Like a mortgage, a community bond is a debt instrument, but it is issued directly by the non-profit organization which will use the funds.

Community Bonds are an existing financial tool which is emerging within the non-profit sector as an innovative way for non-profit organizations to attract capital. Like a mortgage, a community bond is a debt instrument, but it is issued directly by the non-profit organization which will use the funds.

CapacityBuild is uniquely positioned to support your organization’s thinking about the suitability of a community bond to raise money for future projects. Research into the concept of Community Bonds issued by mission based organizations has built on CapacityBuild consultant’s practical experience in non-profit funding models.

A community bond works by enabling the non-profit organization to receive funds from investors which are then used to fund a defined project. The investors receive a bond document which specifies how they will be repaid, the amount and frequency of interest payments and links them to any security which is offered as part of the Bond. Returns to the investor come in the form of a return of their original capital, a financial return on that invested capital and a social return in the form of the community benefit outcomes of the non-profit organization.

A community bond works by enabling the non-profit organization to receive funds from investors which are then used to fund a defined project. The investors receive a bond document which specifies how they will be repaid, the amount and frequency of interest payments and links them to any security which is offered as part of the Bond. Returns to the investor come in the form of a return of their original capital, a financial return on that invested capital and a social return in the form of the community benefit outcomes of the non-profit organization.

In a nutshell, a community bond is:

- A mechanism for raising capital which provides both a financial and community return to investors

- Used by non-profit and charitable organizations

- Requires expertise, resources, planning and project management

- Process includes defining the project, analysis, information package, investor engagement, investor commitment

- From 5 months to 2 years to launch

Download our Community Bonds White paper

For further background, the Community Bond paper provides a more extensive look into the securities regulation environment, what is involved and a process guide to move through the community bond issuing process.